As a familiar idea in China for decades,[i] 'Common Prosperity' is rapidly gaining in prominence. At the 18th Party Congress in 2012, Common Prosperity was declared to be the 'fundamental principle' of Chinese-style socialism. China has achieved its goal, announced in 2012, of eradicating extreme poverty by 2020.[ii] This year, President Xi Jinping highlighted the Party's commitment to Common Prosperity. China's 14th Five Year Plan, covering 2021-2025, calls for an “action plan” to make "solid progress" towards Common Prosperity by 2035 and to "basically achieve" the goal by 2050.

Policy Implications

The essence of Common Prosperity is not egalitarianism but to improve the overall well-being of the population, by providing better social welfare and a stronger social safety net, improving the redistribution mechanism, and to narrowing income inequality.

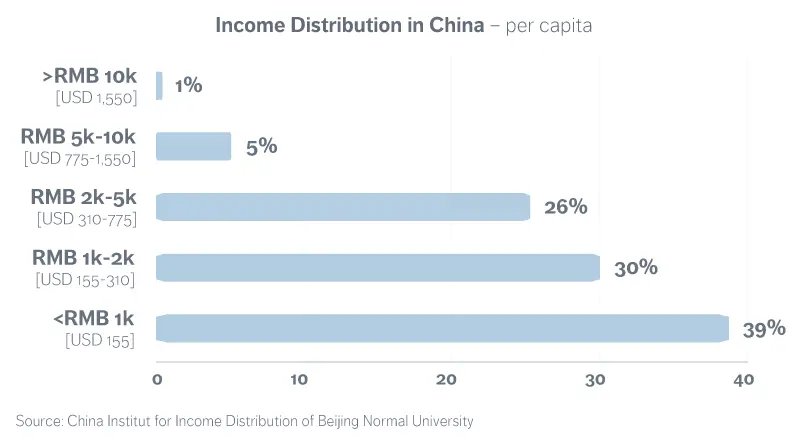

Income distribution in China is undergoing a profound transformation. Nearly 40% of the Chinese population still makes less than RMB 1,000 (~USD 155) income per month. As of 2017, about 30% of the Chinese were in the middle-income groups.[iii] Although there is no strict definition, NBS’s middle-income criteria suggest an annual income between RMB 100,000 to RMB 500,000 (~USD 15,500 to USD 77,500) for a family of three. Common Prosperity policies aim to improve the income of low-income groups, enhance labour protection, expand the middle class, and to reduce costs and spending in key areas of social inequality, such as housing, education, and healthcare.

Chart 1: Income Distribution in China per capita

The Chinese government is pursuing policy changes to

- Generate growth in household income and labour income

- Increase access to public services, including healthcare and education

- Reduce the cost of living and the cost of public services

- Strengthen the social security net, through expansion of pension and overall social welfare programs

- Improve the mechanism of wealth redistribution through tax reform and regulations -- for example, possible reform of personal income tax, consumption tax and property tax

- Encourage the development of “tertiary distribution”, that is, corporate charity and donations[iv]

Government department and corporates are beginning to respond. In June 2021, Zhejiang Province was selected as the pilot zone for Common Prosperity. One month later, the Zhejiang government released a detailed plan, putting middle-income households at the core of the society and setting quantitative targets for 2025. Alibaba and Tencent have each pledged to invest 100 billion yuan (~USD16 bn) over the next few years into the Common Prosperity effort. The founders of Pinduoduo, Meituan and Xiaomi all recently donated to, or increased donations to social causes in China.[v]

Common Prosperity is becoming a comprehensive policy priority, with new regulations for certain sectors. We expect policies to support household income growth will be positive for consumer spending in the medium to long term. The State involvement in public services should increase further. In recent years, property, healthcare and education sectors have seen many changes. In the property sector, long-term deleveraging mechanisms plus tight and targeted property policies are expected to continue, to stabilize housing costs and mitigate systemic risks. The education sector has seen the greatest recent regulatory changes, as the government pushes public schools to take more social responsibility to reduce family expenditure on private tutoring. In healthcare sector, drugs and medical consumables are expected to expand under the volume-based procurement (VBP) policies to reduce healthcare costs for patients.

Common Prosperity will continue to shape the risks and opportunities in this important economy.[vi] Our analysis indicates that de-carbonisation and advanced technology self-sufficiency are long-term policy goals for China. We favour sectors that enjoy policy tailwinds, such as New Energy, Green Tech, New Materials, Advanced Manufacturing and Semiconductors.

We are alert to rising risks in the sectors that face stricter or unclear regulation or other uncertainties, such property, education, and the data security and anti-trust uncertainties in the internet sector. We are selective in the healthcare sector. For healthcare subsectors which are subject to VBP purchasing, as well as for cosmetic surgery and digital healthcare, we expect increased regulation. We expect better opportunities will arise in high-end medical research, innovative drugs, biotech and elder care.

China’s policy priority is gradually shifting from rate of economic growth, to quality and sustainability of economic growth. As the Common Prosperity policies develop, regulatory risks and opportunities will evolve across sectors. We expect Common Prosperity and China’s other long-term policy goals will reward thorough fundamental research.

[i] 'Common Prosperity' was first mentioned by the Chinese Communist Party in 1950.

[ii] China defines extreme poverty as earnings less than $2.30 per day at purchasing power parity. The World Bank’s figure is $1.90 per day.

[iii] National Bureau of Statistics of China, NBS

[iv] 'Primary Distribution' is defined as salary and wages, 'Second Distribution' is taxes, and 'Tertiary Distribution' is charity and donations.

[v] CNBC. China’s Tech Giants Pour Billions into Xi’s Vision of ‘Common Prosperity’. 5 September, 2021. https://www.cnbc.com/2021/09/03/chinas-tech-giants-pour-billions-into-xis-goal-of-common-prosperity.html Accessed 1 October, 2021.

[vi] 35% of MSCI Emerging Markets USD NR index as of September, 2021