China decided to break out from past usual recipes of strongly supporting its economy during downturns by massively investing in infrastructure projects. This time around, the Chinese stimulus programme may seem somewhat modest compared to Western economy equivalents. This action has resulted in reduced excess capacity for the economy and increasing pricing power and margins for industry leaders, which benefited the equity market.

China decided to break out from past usual recipes of strongly supporting its economy during downturns by massively investing in infrastructure projects. This time around, the Chinese stimulus programme may seem somewhat modest compared to Western economy equivalents. This action has resulted in reduced excess capacity for the economy and increasing pricing power and margins for industry leaders, which benefited the equity market.

Growth and themes continued to push most equity indices higher. However, below the surface, equity indices experienced strong sector rotations. Most US equity indices returned high single-digit returns while the other developed equity markets were up low-to-mid-single digit returns. Brazilian, Turkish and Argentinian equities declined between -3.5% and 5%.

Sovereigns and corporate investment grade yields remained relatively stable during the month. The risk-on environment continued to be favourable to high yield, with spreads pressing further down.

Precious metals are among the best-performing commodities this year, which is understandable during crisis periods.However, this year’s best-performing commodity is lumber. Its futures contract increased by 58% in August, taking its year-to-date performance to +129%.

The HFRX Global Hedge Fund EUR gained +1.19% over the month.

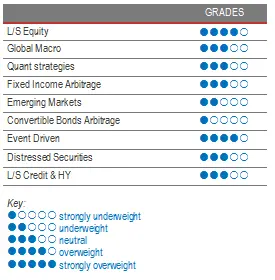

Long Short Equity

On average, August was a good month for Long Short Equity strategies but, considering that style factors and industry tilts were the main performance alpha drivers, there was a high dispersion across the universe. According to prime broker data, US and Asian LS Equity funds returned on average during the month respectively +3.12% and 3.16%, outperforming European LS Equity funds – up on average +2.41%. Growth and quality factors continued to perform very well. Momentum and value factors made irregular contributions to performance. Early August, hedge funds were net sellers of momentum, unloading mainly semiconductors and technology hardware stocks. Value-aware technology investors suffered during the month due to their short positions in new technology stocks versus cash-rich and lower-growth “traditional” tech companies. Although diversification has not paid as well this year as being all-in in technology or growth thematics has, LS Equity as a strategy is very rich and diverse in terms of styles, possessing several tools capable of facing most market environments. Although current average gross and net exposures are at multi-year highs, net exposures will probably decrease going forward as investors continue collecting additional data on the state, the economy and corporations, and the market reverts further to fundamentals.

Global Macro

According to indices, discretionary global macro managers outperformed systematic strategies during the month. Since the beginning of the year, discretionary strategies have clearly led the way, with indices returning slightly above mid-single-digit returns while systematic strategies are slightly negative. Winning bets on long equities, long precious metals and long bonds were balanced by losses on long Emerging Market rates and commodities. This is an example of some of the current trades, as a high level of uncertainty usually leads to a dispersed positioning across the universe. In this sentiment-driven environment, we tend to favour discretionary opportunistic fund managers who can draw on their analytical skills and experience to generate profits from selective opportunities worldwide. The stabilisation of the market and increased visibility in macro-economic data should lead to better performances from systematic strategies, with expected realized volatility levels lower than those of the more concentrated discretionary managers.

Quant strategies

There was a relatively high level of dispersion across the universe during the month. Trend followers tended to print flat returns, with gains in equities and currencies balanced by losses on fixed income and commodities. Slightly improving economic indicators slightly lifted the back end of the yield curve, inverting a long-term downward trend. 2020 has not been an easy environment for Quantitative Strategies. Models had difficulties dealing with the violent and rapid increase in market volatility and asset correlations. The extreme and prolonged volatility levels reached during March led to a significant deleveraging of quantitative strategies, generating poor performance and leading to more deleveraging. The implementation of the stock-shorting ban on some European countries helped accentuate the deleveraging effect as managers were unable to implement or adjust the optimal portfolios of long and short securities as defined by their model.

Fixed Income Arbitrage

If Fixed Income Relative Value had one of its most spectacular months in history in March 2020, it did highlight the need to be invested in managers with strong set-ups (secured term repo lines with high-quality counterparts and longstanding relationships). At the end of March, our managers took advantage of the dislocation within the US basis to post historical positive returns from what has been a once-in-a-decade opportunity. Like other RV trades, if spreads have been wider than they were pre-crisis up to July, they are now slowly coming down to their lows on the back of ongoing central bank rhetoric, poor GDP numbers and very low realized volatility. However, potential inflation scares or stronger US growth could trigger change without notice. As such, we are reviewing potential candidates that could benefit from such an environment.

Emerging markets

The US Federal Reserve announcement stating that it would adjust its inflation target objective to focus on an average inflation target had a positive effect on Emerging Market assets’ investor sentiment. High Yield credit – led by the successful Argentinian debt restructuring – outperformed Investment Grade. The opportunity set in Emerging Markets Fixed Income is characterized by an attractive yield since, despite a strong summer in terms of performance, the asset class has substantially underperformed Developed Markets since the start of the crisis. It is also a highly idiosyncratic investing ground since, on top of the macro-economic situation of each country, the political situation within each region is very different, leading to a wide set of long and short opportunities. The macro outlook remains extremely foggy for Emerging Markets. However, fundamental managers stress that, in a zero-rate world, Emerging Markets is the only alternative for those wishing to invest in yielding fixed income. Considering the fragility of fundamentals, they usually adopt a very selective approach. Trades are mainly implemented by investments in fixed income, credit and currencies, where the pricing of risk led by fear is creating massive dislocations and opportunities by ignoring the fundamentals specific to each region. Nonetheless, caution is required, due to the higher sensitivity of the asset class to investor flows and liquidity.

Risk arbitrage – Event-driven

The deal-making momentum initiated in July continued into August. Global M&A during the month totalled $290 billion, which represents an increase of 2% compared to 2019 levels. The US continues to lead the way, with a deal volume driven by US companies representing more than 50% of the total volume. Europe and Asia also saw an uptick in M&A activity. After the market rally, companies used their high stock valuation as a currency to pursue domestic consolidation by acquiring smaller or distressed peers, to build scale or to pursue growth opportunities. Hence deal activity is expected to remain sustained for some time to come. Alongside corporates’ capital market access, M&A activity is expected to be sustained by Private Equity vehicles holding around USD 1.5 trillion in dry powder to seek deals and be among the increasing number of Special Purpose Acquisition Companies (SPACS) that were created this year alone. Nonetheless, it is important to remain selective in deal selection due to the increased risk of deal failure, as exemplified in early September by the case of Tiffany’s suing LVMH over stalled takeover talks.

Distressed

Distressed strategies had a nice boost in August, when the Argentinian government reached an agreement with its main creditors for a restructuring of USD 65 billion of debt, with extended maturities on the debt and lowered interest rate payments. The opportunity set is widening and getting bigger by the day but it is going to be a tough battle, as corporations are trying to pile on further debt to navigate through the crisis, opening up battle lines with existing creditors for current collateral. We favour experienced and diversified strategies to avoid having to face extreme volatility swings. It is not going to be easy but this is the environment and opportunity set these managers have been waiting for this last decade.

Long short credit & High yield

Credit spreads for Investment Grade and High Yield markets reached extreme levels unseen since the crisis of 2008. The market was also highly affected by the lack of liquidity, prompting the ECB and the Fed to step up their IG debt-purchasing programmes. The Fed also decided to include High Yield in its buying programmes to smooth the high amount of Investment Grade fallen angels downgraded to High Yield. Rating agencies forecasted that the amount of fallen-angel debt could reach $700 billion in the US, probably too big to be absorbed by the HY market smoothly. Investment Grade and short-term High Yield issue spreads reacted very quickly to liquidity injections, especially in the US. According to the managers we track, while this move in higher-quality issues was widely expected, there are still many opportunities in High Yield but also in the cross-asset relative value trades (long bond vs short equity) and intra-asset RV trades (long bonds and long protection) generated by the market dislocations. Contrary to 4Q 2018, opportunities offered in credit will take longer to be arbitraged, leaving time for investors to review their allocations.