European equities: Strongly declining volatility

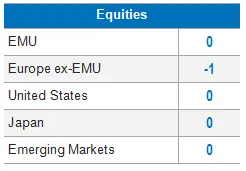

Regarding economic data, PMIs and the German IFO for April dropped as a result of further lockdowns, further deterioration in the labour market and a longer-than-expected recovery. We started to see some equity inflow in Europe at the beginning of May, with investors hoping that the worst was behind us, and most European countries having peaked in terms of Covid cases in April. May, moreover, should mark a turning point, and leading economic indicators should improve in the coming months as economic activity restarts.

Regarding economic data, PMIs and the German IFO for April dropped as a result of further lockdowns, further deterioration in the labour market and a longer-than-expected recovery. We started to see some equity inflow in Europe at the beginning of May, with investors hoping that the worst was behind us, and most European countries having peaked in terms of Covid cases in April. May, moreover, should mark a turning point, and leading economic indicators should improve in the coming months as economic activity restarts.

In our view, the European economy, in line with the potential strong economic rebound, should offset most of its EPS losses by 2021.

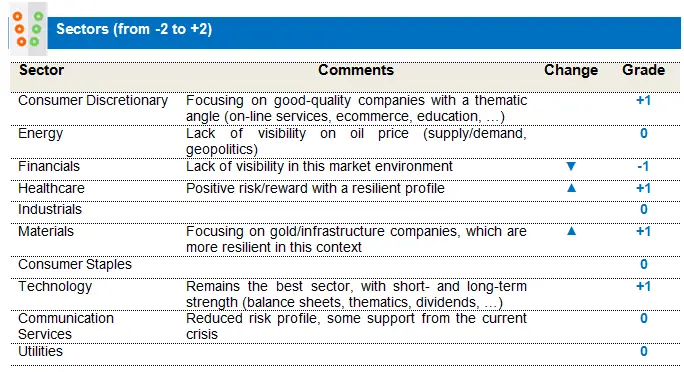

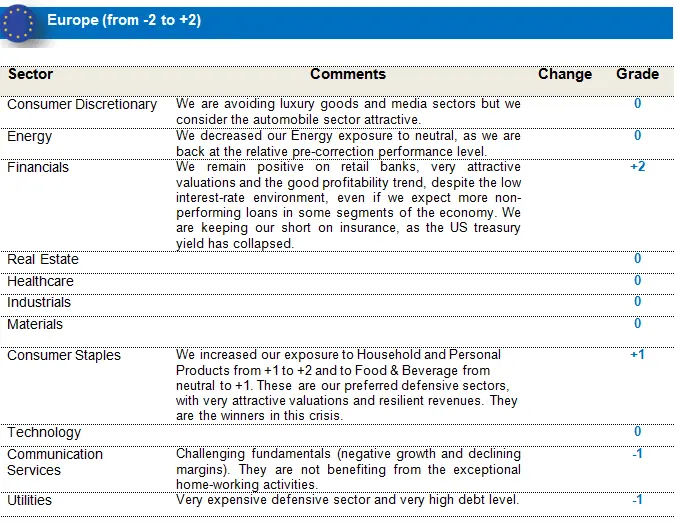

Healthcare and IT have been the best performers since our last committee. Despite high valuations, Coronavirus continues to cause a flight to safety/quality in favour of the Healthcare and IT sectors, as they are both playing an important role in the fight against the virus. Consumer Discretionary, priced to cater for the worst-case scenario, is tending to recover now with the end of containment measures. Energy and Communication Services clearly underperformed.

An interesting point to highlight is that Financials sharply outperformed at the end of April as the ECB decided to implement a number of modifications to the terms and conditions of its targeted longer-term refinancing operations (TLTRO III) in order to support further the provision of credit to households and firms in the face of the current economic disruption. Financials lost some gains at the beginning of May as investors awaited more visibility regarding non-performing loans.

In term of style, Small Caps strongly outperformed while Value continued to underperform, and price discounts were extreme.

Value has never been this cheap relative to Growth in Europe

Growth style has significantly outperformed its Value counterparts since the global financial crisis (GFC), claiming all-time highs, an extreme level that has never before been reached. Conversely, Value style, driven by low and falling interest rates since the GFC, has suffered the most.

The Value train is still immobile at the station, but until when?

Given the recent market drop, there are still opportunities to be found in European equities. The sell-off so far has been highly indiscriminate, with ‘good Value’ being sold off alongside ‘bad Value’. But for Value stocks that are able to survive this crisis, returns from this point could be very favourable.

Experience tells us that we could face a style rotation, with a Value run once the impact on earnings is known.

Value stocks should outperform Growth stocks in the short term in the light of more stable European and US bond yields, appeased trade relations, stabilizing macroeconomic data, an economic recovery and accommodating monetary policies. All these factors should boost Value stocks.

As a result, we are keeping our strong conviction on retail banks, based on very attractive valuations. We are also keeping our short on Insurance, as Insurers’ solvency ratios have sharply decreased. In addition, the current yield curve is not supportive of the sector. We are keeping our positive view on Automobile, as price discounts are extreme (even deeper Value). We'll continue to closely monitor Value style performance during the market recovery in the coming weeks and months. We expect a significant rebound of this style in the coming weeks. We are keeping our neutral grade on Energy, as oil prices may stay low for a long time. In addition, we are also keeping our positive exposure to Household/Personal Products and Food/Beverage, as they still have attractive valuations, resilient revenues and are delivering good returns to shareholders.

US equities: Outperforming Cyclical sectors

The global stock market rebound in April was almost as spectacular as the brutal correction in February-March. Investors turned abruptly positive on several factors. Powerful central banks and fiscal stimuli are understood to be helping us get over the chasm of the catastrophic 2Q20 economic/earnings plunges. Covid-19 data are starting to turn positive, when considering hospitalizations, recoveries, treatment options and progress towards testing, tracing and even vaccines. The very gradual re-opening of the economy is reviving hopes that the worst of the coronavirus crisis is over. Q1 earnings and accompanying Q2 guidance are in general not as bad as feared.

US equity markets jumped, reversing further some of the March weakness as the number of US Covid cases improved throughout the month and curves flattened/peaked in many US states. Moreover, the Fed implemented several more actions to cushion the economy by providing up to $2.3 trillion in credit to businesses, states and local governments through new lending facilities.

Regarding the economic indicators, jobless claims spiked, with a 20% unemployment rate in the country. In addition, Q1 GDP contracted by 4.8% and US Treasury yields fell -3.0bps to 0.64%. Moreover, based on the 24% of S&P 500 companies that have reported so far, 42% are beating Q1 earnings and 41% are beating revenue estimates, which is, in general, not as bad as feared.

We started to see some equity inflow at the beginning of May, as investors hoped that the worst was behind us. Moreover, leading economic indicators should improve in the coming months, as economic activity restarts.

In our view, the US economy, in line with the potential strong economic rebound, should offset EPS losses by 2021.

As could be expected, cyclical sectors such as Energy, Materials, IT and Consumer Discretionary clearly outperformed. We saw a massive overshooting on Energy, Materials and Consumer Discretionary, sectors that had been priced to cater for the worst-case scenario but that are now tending to recover with the end of the containment measures. Information Technology is the clear winner in this crisis, as new technologies are playing an important role in the fight against the virus. On the other hand, defensive sectors (e.g. Utilities, Telecom and Consumer Staples) underperformed. In term of style, Quality stocks and Small caps were the best performers in April.

We continue to see strong dispersion across sectors, as Financials, Industrials and Energy continue to lag. On the other hand, IT and Communication Services strongly outperformed this month, while the Healthcare sector, which has performed particularly well since the beginning of the crisis, is starting to lag. Moreover, we can highlight that Growth has never been as expensive as it now is compared to Value.

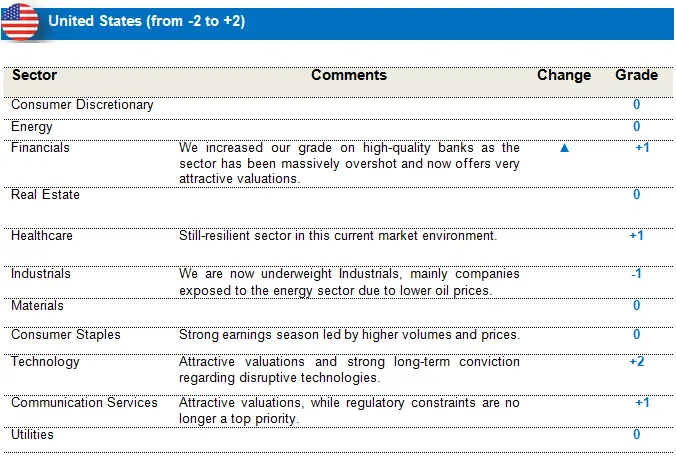

All of our bets – underweight Industrials, overweight Healthcare and Communication Services, strongly overweight Information Technology – paid off.

We increased our grade on high-quality banks as the sector has been massively overshot and now offers very attractive valuations. The sell-off so far has been highly indiscriminate, with ‘good Value’ being sold off alongside ‘bad Value’. But for Value stocks that are able to survive this crisis and come out on the other side, returns from this point could be very favourable. We are keeping our strong overweight on Information Technology, despite high valuations, as the coronavirus epidemic is accelerating the adoption of new disruptive technologies (Home-working, 5G, Cybersecurity, …). We have also kept our overweight on Communication Services exposure, based on attractive valuations, while regulatory constraints are no longer a top priority given the current economic context. Finally, we are keeping our positive exposure to Healthcare, despite high valuations, as we currently can’t see any factors that could create a downtrend.

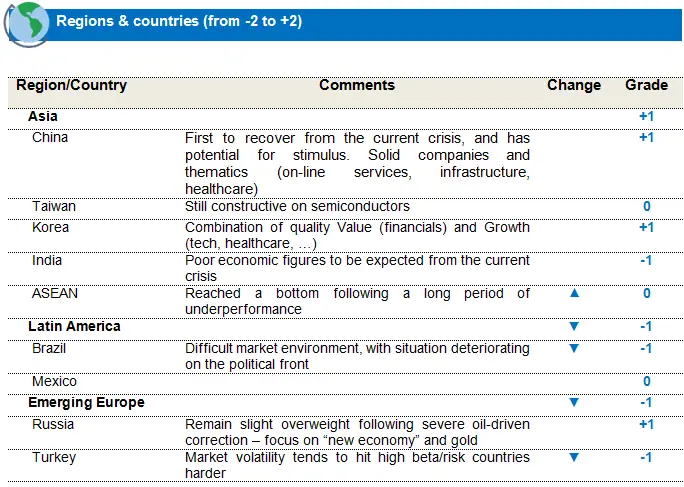

Emerging equities: Emerging markets have somewhat stabilized

After a historically bad Q1 performance, Emerging Markets rose 9% in April, while underperforming DMs by 1.8%. Hopes of re-opening the economy are improving worldwide, with unprecedented fiscal and monetary support behind the strong market recovery, while 11 EM central banks cut rates during the month.

Asia performed best, with China up, driven by the gradual recovery of the demand and the supply sides, both now mostly back to capacity, while India experienced a sharp rebound, thanks to the RBI announcing measures to counter the economic impact of the pandemic and lockdown. Taiwan rose, thanks to returning foreign inflows, a positive 5G outlook, PC and server demand, and the recovery of smartphone demand, all of which helped the IT sector. ASEAN, too, recovered, after a strong underperformance in Q1. EEMEA, too, rose, thanks to the strong Materials sector and despite South Africa's debt being downgraded to junk. LatAm lagged most, suffering from the coronavirus but also due to political turmoil in Brazil involving the president and key members of his government.

The dollar and EM FX remained flat, with some strong recovery from the Indonesia Rupiah, the Russian Ruble and the Chilean Peso. Commodity prices, especially precious metal prices, rose, as the environment remained uncertain, while oil prices came under pressure in April because of oversupply and related storage concerns (they even turned negative for the first time in history) but recovered towards month's end. Among sectors, Materials and Healthcare topped the charts.

We remain constructive on North Asia (China, Korea, Taiwan). Our thematic approach led us to increase exposure to sectors benefiting from the coronavirus pandemic, such as (1) e-commerce, (2) Work-from-home/teleworking, (3) digital/physical infrastructure. Those were funded by reducing our Financials exposure to ‘underweight’. Conversely, we increased our Healthcare exposure to ‘overweight’, mainly through healthcare equipment & services.

We turned ‘neutral’ ASEAN, as the region reached a bottom following a long period of underperformance, although it did recover somewhat in April 2020.

We reduced our EM Europe and LatAm exposure to ‘underweight’. We reduced our exposure to Turkey and tactically reduced our Brazilian exposure to ‘underweight’ as the situation deteriorated on the political front. Meanwhile, we are focusing on good-quality companies exposed overseas while reducing our exposure to domestic companies.

We increased our Materials exposure to ‘overweight’, mainly focusing on gold/infrastructure-related companies.