European equities: Small caps continued their outperformance

European equities had a strong run over December, following positive economic data (PMI was revised up significantly) and good political news regarding Brexit and the trade war.

European equities had a strong run over December, following positive economic data (PMI was revised up significantly) and good political news regarding Brexit and the trade war.

We saw some equity outflows in Europe through the month beside positive economic sentiment.

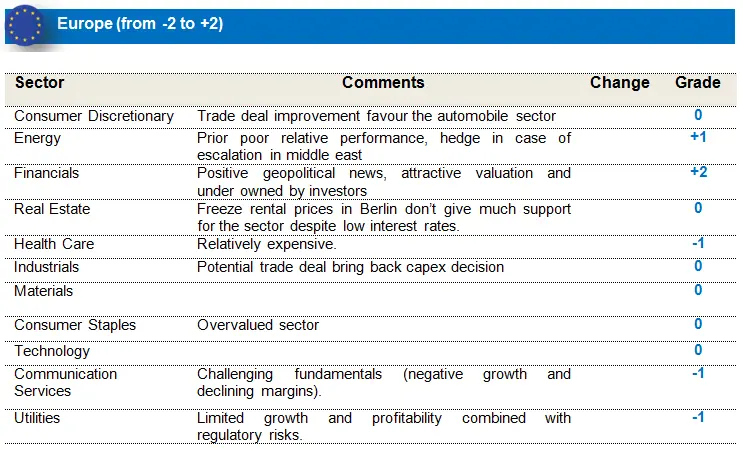

Small caps continue to outperformed as positive outcome to the Brexit negotiations act as a supportive factor. Banks were among the best performers, supported by higher bond yields, steeper curves, and a soften in regulation. Telecoms, Automobiles and Food & Beverages were the worst performing sectors.

We increased our Energy exposure at the beginning of January. This sector has been one the worst performer in 2019, oil price increased, and some of European names offer attractive valuation. We also increased our positions in retail banks during December as they are rather cheap with potential upside on the short term. In addition, we keep our cyclical bias while being underweight on Telecoms, Utilities and Healthcare.

US equities: Higher PMI than expected

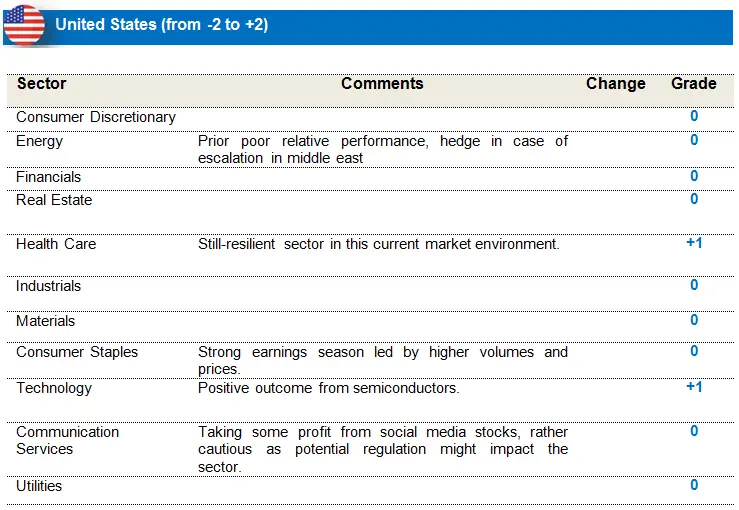

US equities had a strong month in December with Information Technology and Semiconductors performing well while Industrials underperformed and US Treasury yield rose.

In December Services PMI came out higher than expected. Markit PMIs and the ISM for December gave a mixed picture but the labour market for November remained very strong and the unemployment rate ticked even lower to 3.5%. We continue to see strong relative performance in Information Technology and Health Care, with solid positive earnings revisions and positive sales surprise. Energy continue to underperformed but we see strong change in EPS growth 12 month forward.

We continue to see poor relative performance in Energy, but the Iranian conflict act as a strong catalyst for oil price. Taking some positions in this sector could act as a good hedge in case of escalation in Middle East. As a result we tactically cut our underweight to neutral. We keep our ‘overweight’ Health Care and Technology as those sectors continued to deliver strong results.

Emerging equities: The Phase I trade deal supported the markets.

Global risk-on sentiment – driven by hopes of an agreement on the Phase I trade deal between the US and China, indications of stabilizing global and China growth, accommodative central banks and slowing social unrest in Latin America and Hong Kong – resulted last month in strong gains for Emerging Markets equities, which saw them strongly outperform Developed Markets.

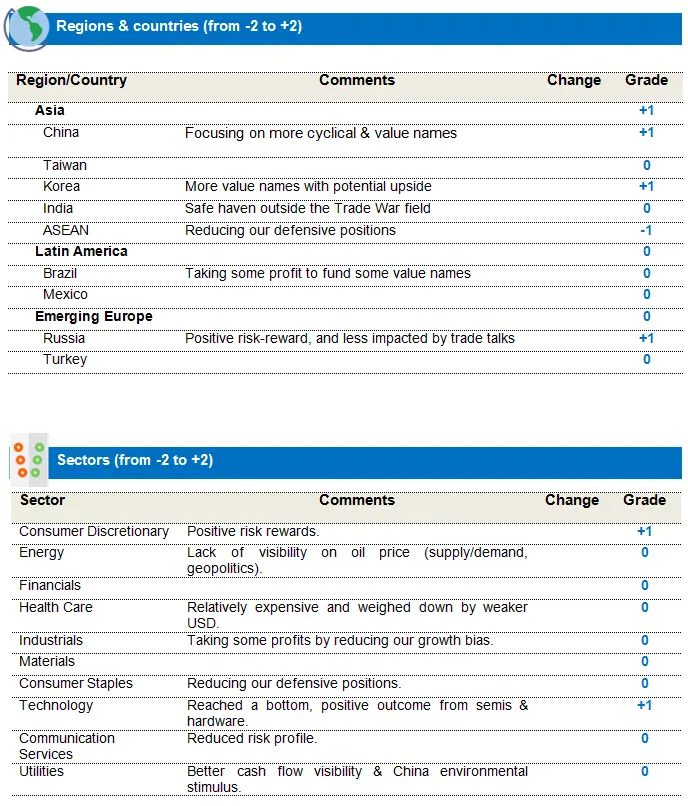

LatAm outperformed other regions, with Brazil rallying on positive monetary reform and economic news flow, while Argentina, Chile and Colombia showed some signs of recovery. Also in Asia, China gained, thanks to the expected Phase-I trade agreement, with reduced tariffs in both directions (initially scheduled for 15 December), economic stabilization and more policy easing. Although Indian equities gained, they remained volatile on central bank policy, and there was also positive news on a new infrastructure stimulus plan. EMEA also gained, with Russia rallying on rising Brent prices and a rate cut, and Turkey welcoming another rate cut. Oil, gold, nickel, aluminium and copper rallied. In addition, most EM currencies managed to gain against the dollar. In terms of sectors, Information Technology and Materials performed best in December.

Overall, even though they underperformed Developed Markets, 2019 was a strong year for Emerging Markets, with Russia and Taiwan leading the main markets, and all sectors gaining, with Technology the best-performing one.

We remain positive on a slow recovery of global growth, low inflation and accommodative monetary policies worldwide, supporting our expectations of a faster earnings recovery for emerging markets in 2020.

We continue to keep our neutral positions in Brazil and Taiwan with a slightly positive stance towards value names. We keep our overweight in China and reduced our positions in ASEAN to be underweight. We also keep our overweight position in IT (mainly towards hardware & semiconductors) while reducing our defensive exposure through Consumer Staples by being underweight.